The 2022 Economic Outlook for Small Architecture Firms

A CVG Roundtable Discussion Summary

Every month, CVG hosts an Investment Partner’s Roundtable where we gather clients and CVG staff to discuss topics of specific interest to small design firms. These casual conversations lead with a client or CVG team member presenting an idea – often a unique solution they’ve found for a common challenge – then participants share their experience with the group. The format promotes valuable knowledge sharing in a non-competitive environment.

In January we discussed the economic outlook for 2022. CVG’s Sun Joo Kim and Rena M. Klein, FAIA presented forecasting research, and firm leaders from across the U.S. and Canada shared their observations about the economy, the state of their pipelines, staffing shortages, and more. This blog post summarizes the discussion.

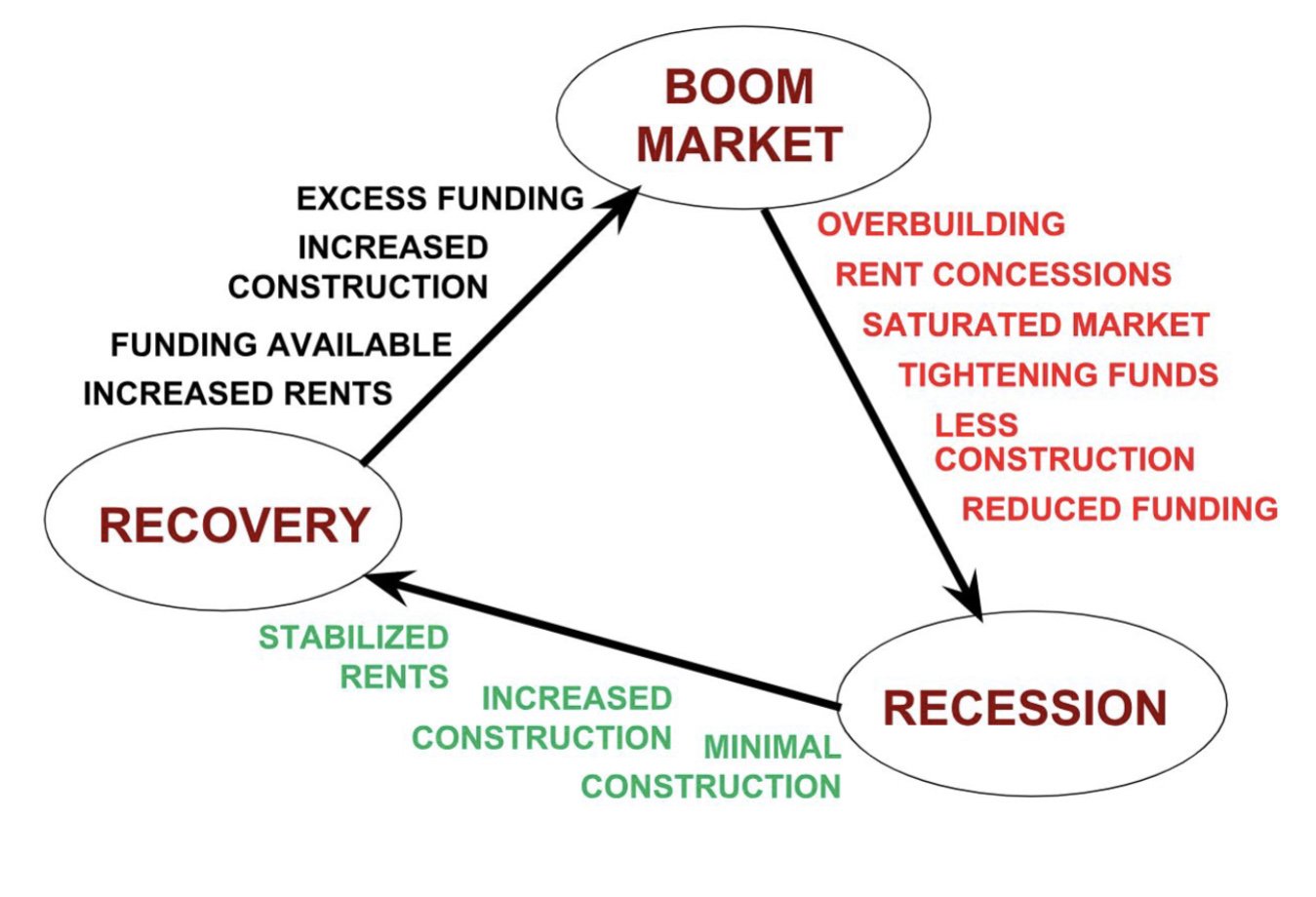

The Roundtable agreed that our industry is in a Boom Market. We compared the typical construction business cycle of boom-recession-recovery with the highly unusual business cycle we’ve experienced in the past few years:

Typical pattern of the construction business cycle

COVID has disrupted the typical construction business cycle.

The U.S. has experienced steady GDP growth without inflation for a while, typically between 3-4%. The predictions for 2022 have GDP growth at 3-3.5%, according to The Capital Group and The Conference Board, with inflation peaking in February 2022, assuming an interest rate correction.

We viewed economic indicators from the U.S. Census Bureau in areas that impact the A/E/C industry, such as 2021 Construction Expenditures ($1.625B!), New Housing Starts, and the Architectural Billing Index (ABI). The ABI began to turn downward at the end of 2021, but still remained stronger than predicted. Before the Great Recession in 2008, the ABI dropped ahead of indexes tracking other industries.

Rena M. Klein, FAIA, a partner at CVG, emphasized that each firm should define (and watch) the economic indicators that are linked to their firm’s specializations. She noted that “consumer confidence is a good indicator to watch, particularly for a residential practice.” Relatedly, a principal from a high-end residential firm in the Southeast has perceived new hesitation from clients about moving forward within the past three months.

Increased demand for housing will likely continue to fill the pipeline for residential architects, particularly multi-family housing. Multi-Housing News says that 4.6m new housing units will be needed across the U.S. in the next few years, with 11.8m housing units needing renovation.

CVG’s Roundtable participants who are active in multi-family housing noted the impact of construction costs on the pace of development. One West Coast firm observes multi-family clients making fast decisions on team selection and then moving with an accelerated timeline, putting a strain on resources and project planning. Two West Coast firms said that delayed permitting (mainly due to the impact of COVID on planning department staffing) affected their workflow considerably.

All market sectors are being negatively impacted by supply chain issues and changing material costs. One single-family residential designer commented on how she has altered her design process; by making certain decisions earlier in the design process, extended lead times are accounted for. A hospitality design principal in the Midwest echoed this experience.

Construction Administration was also a hot topic. Many firms spoke about the difficulty they are having managing CA on projects that drag out due to extended construction schedules. An East Coast firm leader limits the time spent in specific project phases and shifts billing to additional services after a certain date.

The biggest shared pain points involved inflation, changing material costs, elevated staffing costs, and the resulting pressure on fees. Some firm leaders discussed their need to change billing rates to cover costs and buffer for uncertainties. All eyes will be on inflation and the changing costs of doing business in this unique environment.

With fluctuating timelines and fees, one firm leader emphasized the importance of having clear conversations with clients early in the design process explaining changing supply costs; specifically, how we’re all affected by uncertain market conditions. Another principal said, “last year was a master’s degree in managing client expectations.”

The good news is that the firms at the Roundtable are feeling confident about 2022, as of mid-January.

If you’d like to discuss how your firm is planning for 2022, schedule a free business consultation call with CVG.